El Agente Comunitario de Salud

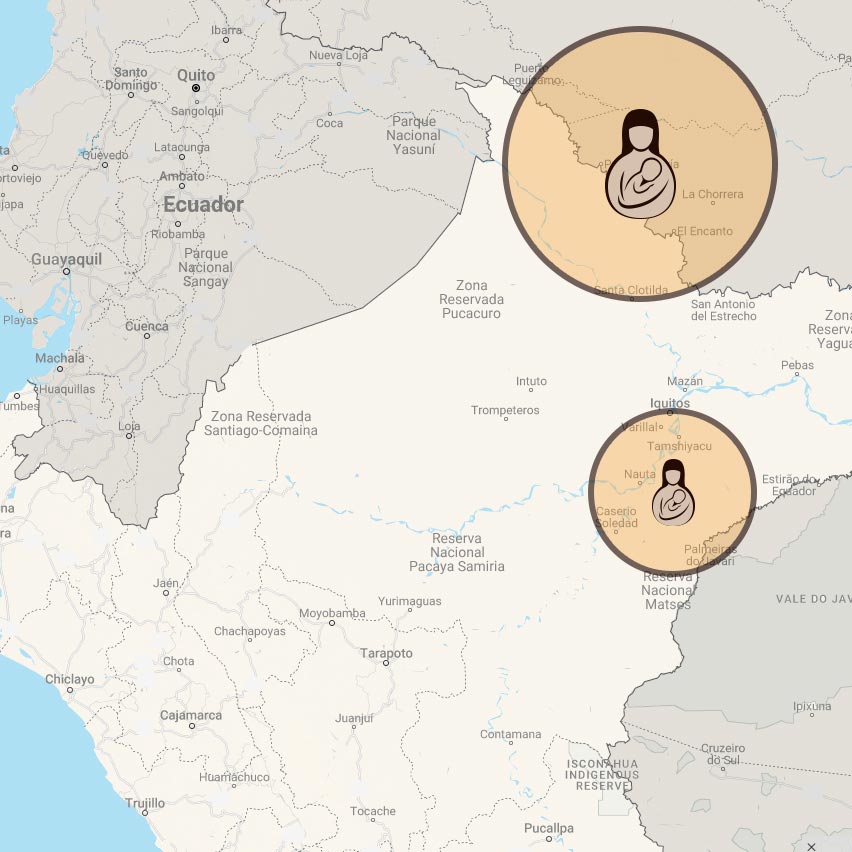

Hacemos un reconocimiento de las cuencas y visitamos al líder de cada comunidad, ellos eligen a su Agente Comunitario de Salud (ACS) a través de una asamblea. El ACS visita la comunidad, realiza pruebas de embarazo y capta a las gestantes registrando su información en la tableta, luego de eso realiza 3 visitas antes del parto, en las cuales lleva información sobre prácticas de prevención sencillas y reconocimiento de señales de alarma.

El ACS tiene como objetivo incentivar a las gestantes a que realicen sus controles prenatales en su centro de salud, busca vencer cualquier obstáculo, duda o temor que la futura mamá o sus familiares puedan tener y que les impida acceder a los servicios de salud más cercanos a su comunidad.

Realizan juntos un plan de parto, tomando en cuenta cada factor necesario para que resulte exitoso, sea un parto institucional o en casa. Se les entrega un kit de parto limpio con artículos esenciales para mantener la limpieza y seguridad durante el nacimiento. Involucran, además, a todos los actores clave: Familia, padrinos, partera y previenen lo necesario en caso de una emergencia.

Si la mamá decide dar a luz en su casa, el ACS y la partera están entrenados para realizar el cuidado térmico y del cordón del bebé, así como incentivar la lactancia materna inmediatamente después del nacimiento.

Cuidados del recién nacido

Luego del parto, el ACS realiza 3 visitas durante los primeros 7 días de vida del bebé, en estas visitas pesa al bebé, verifica que este sano y corrobora que se estén tomando en cuenta las posibles señales de alarma que previamente se le ha enseñado a la mamá, a la partera y a la familia. Nuevamente, se les incentiva a visitar el centro de salud para realizar el registro del recién nacido, motivar su vacunación, controles de niño sano y la obtención de su documento de identidad.